What Is A Covered Call Etn

A key to the covered call. A covered call is a transaction in which a seller of call options owns a corresponding amount of the underlying asset such as the SLV Shares.

A Slideshow Of The Top 10 Stocks Held By Bridgewater Associates Lp Bridgewater Hold On Fund Management

Its similar in many ways to a mutual fund but it trades on an exchange like a stock.

What is a covered call etn. However the covered call strategy may result in a reduction in our ownership if some or all of the shares are called away through the sale of covered calls. What Is a Covered Call. A covered call or buy-write is an income-producing strategy whereby an investor sells or writes a call option against shares of stock that they already own.

The buyer of a call option is long the underlying asset at the strike price. If you issue a call option without actually owning the underlying shares that you promise to. Issuing a call option.

Therefore one percent covered call monthly income is a conservative estimate. A covered call is an options strategy. The covered-call ETF Call option.

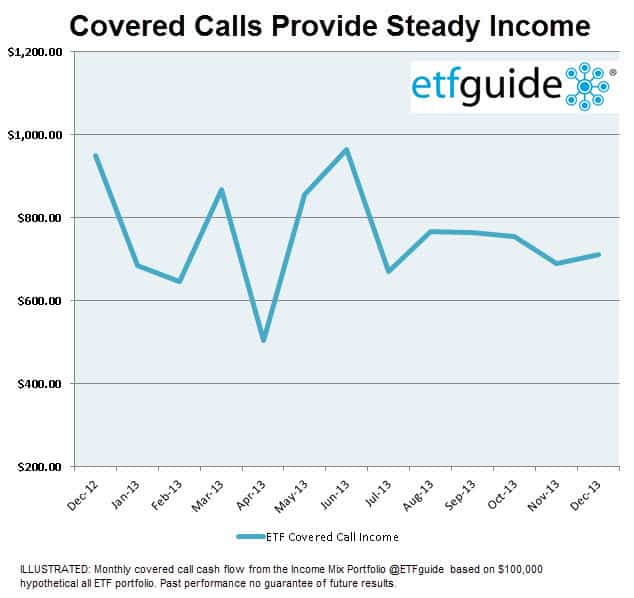

Covered Calls ETF Overview With 20 ETFs traded on the US. 1 is the current unrealized profit and 2 is the profit from the sale of covered calls excluding the most recent profit of 199. The note seeks to.

This means that for a 500000 stock portfolio covered call income estimates range from 6000 to 24000 a year. You buy or already own a stock then sell call options against the shares. Markets Covered Calls ETFs have total assets under management of 498B.

A covered call refers to a financial transaction in which the investor selling call options owns an equivalent amount of the underlying security. Covered-call or buywrite options allow an investor to hold a long position in an asset while simultaneously writing or selling call options on the same asset. With a call option the holder of the call option has the right to buy the underlying at a predetermined.

Some of MarketBeats past winning trading ideas have resulted in 5-15 weekly gains. The person you sold the options to has the right to. When an investor with a long position in a particular asset sells a call option for that asset generating a profit in the process it is considered a covered call.

A covered call ETF. Covered Calls For Eaton Corp Plc ETN Expiration Strike Call Bid Net Debit Return If Flat Annualized Return If Flat. Traders would typically employ a covered-call strategy when they have a neutral view of the markets over the short-term and just gather income from the option premium.

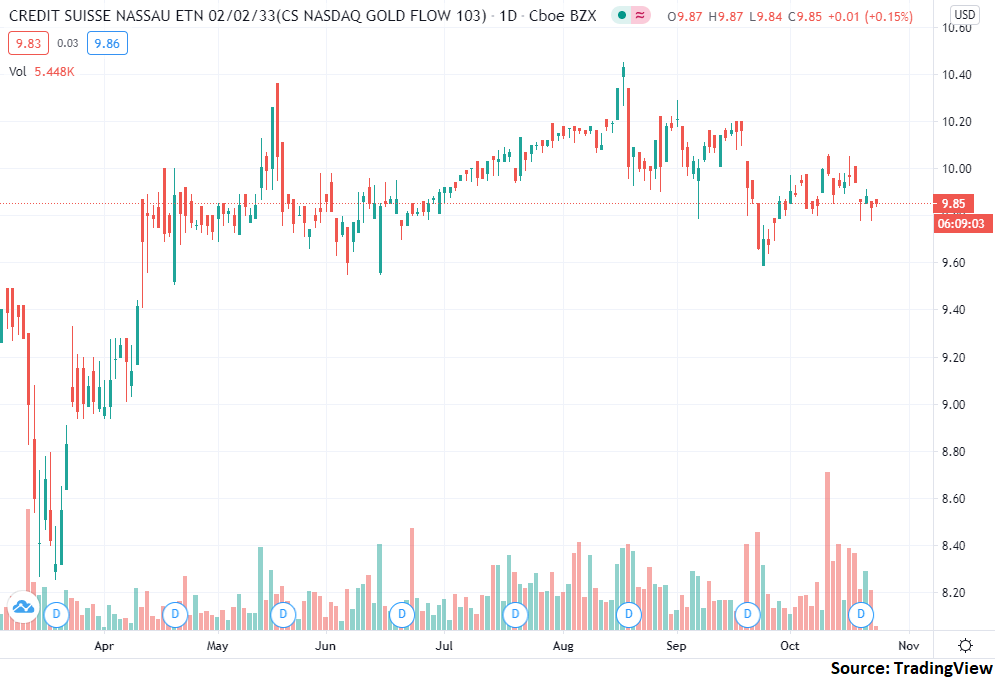

Cindie and I own 500 shares of ETN as a long-term investment. The ETN provides the return of USCFs popular front-month oil ETF USO coupled with a notional short position in USO calls expiring the next month with strike prices 6 out of the money. Credit Suisse X-Links Crude Oil Shares Covered Call ETN is an exchange traded note launched by Credit Suisse AG Nassau Branch.

Covered call income realistically ranges from 6 to 24 or more annualized depending on a stocks movement and volatility. The option sellers long position in the underlying asset is said to provide the cover. To execute this an investor.

A covered call is a transaction in which a seller of call options owns a corresponding amount of the underlying asset such as the GLD Shares. Credit Suisse X-Links Crude Oil Shares Covered Call ETNs stock was trading at 1125 on March 11th 2020 when Coronavirus COVID-19 reached pandemic status according to the World Health Organization. An exchange-traded fund ETF is a basket of securities such as stocks bonds or commodities.

For example an investor that owns 100 shares of Microsoft Corp. The buyer of a call option is long the underlying asset at the strike price. MSFT might sell write one call option contract that gives another investor the right to purchase their shares at a.

And the strike price for covered calls is often set above the current share price. Since then USOI stock has decreased by 527 and is now trading at 532. The option sellers long position in the underlying asset is said to provide the cover.

While ETNs are sometimes grouped alongside ETFs the big umbrella term that covers both of them is ETP. Wall Street analysts have given X-Links Crude Oil Shares Covered Call ETN a NA rating but there may be better buying opportunities in the stock market. The average expense ratio is.

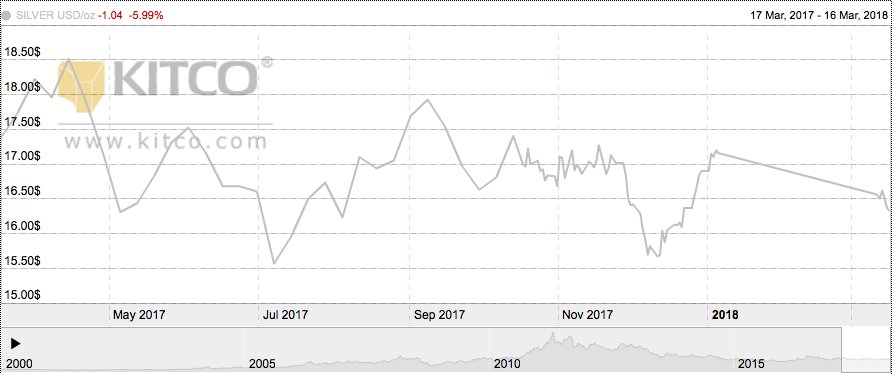

Credit Suisse X Links Silver Shares Covered Call Etn Nasd Slvo Seasonal Chart Equity Clock

If Vix Shoots Up Here S An Etn To Hedge Short Term Volatility Investing Com

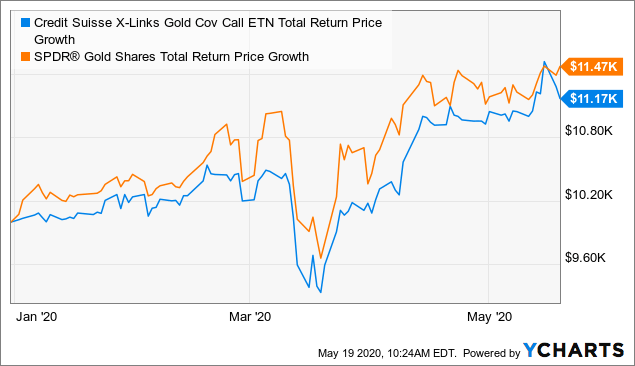

Credit Suisse Gold Shares Covered Call Etn Play Gold And Get A High Yield With These Notes Nasdaq Gldi Seeking Alpha

Las Vegas Sands Has Sustainable Earnings Growth Which Will Provide Price Appreciation And Support Dividend Growth Growth In Macau Sp Las Vegas Dividend Vegas

What Makes Covered Call Etfs So Lackluster Seeking Alpha

Interesting Etn Put And Call Options For August 20th Nasdaq

If Vix Shoots Up Here S An Etn To Hedge Short Term Volatility Investing Com

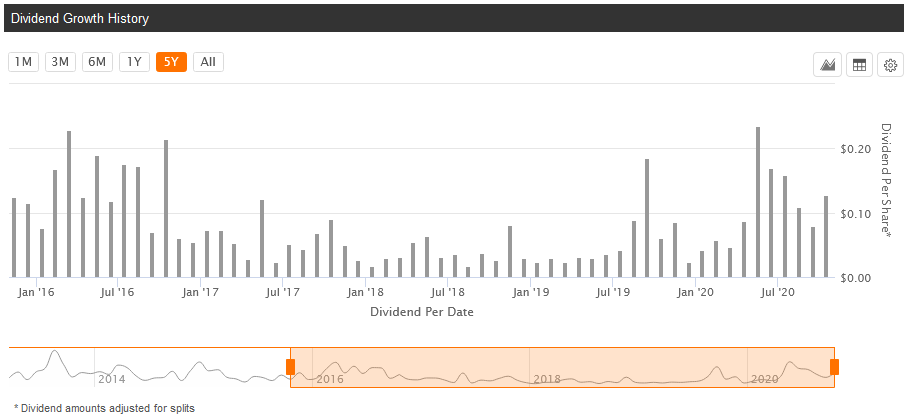

Credit Suisse X Links Gold Shares Covered Call Etn Nasd Gldi Seasonal Chart Equity Clock

Trade Idea Vxx Synthetic Poor Man S Covered Call For Amex Vxx By Naughtypines Tradingview

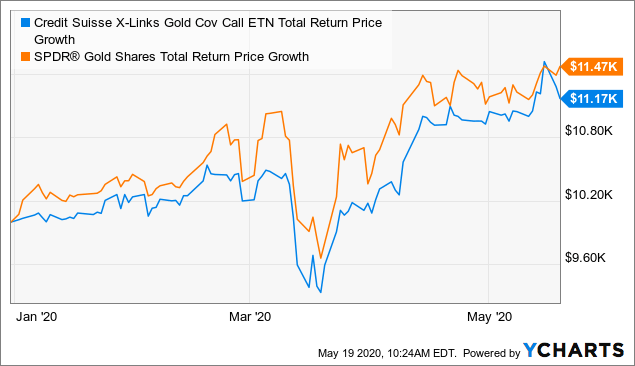

Credit Suisse Gold Shares Covered Call Etn Play Gold And Get A High Yield With These Notes Nasdaq Gldi Seeking Alpha

Gldi A Strong Holding For Certain Investors Nasdaq Gldi Seeking Alpha

It S Looking Like A Fine Time To Consider Covered Call Etfs Nasdaq

Are Covered Call Funds A Smart Income Play Etfguide

Credit Suisse Gold Shares Covered Call Etn Gives You Gold And Income With A Big Caveat Nasdaq Gldi Seeking Alpha

A53788 Htm Generated By Sec Publisher For Sec Filing

Credit Suisse Silver Shares Covered Call Etn A Good Holding For Silver Bulls Right Now Nasdaq Slvo Seeking Alpha

Post a Comment for "What Is A Covered Call Etn"